News

Planning to make an equipment purchase before year-end? Now is a great time to evaluate your machinery line-up, review your records and discuss options to reduce your tax liability with your accountant.

Whether you’re looking to purchase new or used equipment, leasing can provide flexibility for controlling cash flow and serve as an effective tax management tool. Learn how leasing can benefit your operation by assessing the five factors below.

Cash flow management

The rising cost of machinery has challenged producers’ cash flow management in recent years. Leasing is one solution that can be used to reduce debt and save working capital that would otherwise be used to purchase assets.

In addition to adjusting the length of term, frequency of payments and residual value of the equipment at lease end, machinery lease payments are often lower than loan payments, and in some cases, cash flow can be recaptured by selling assets and then leasing them back.

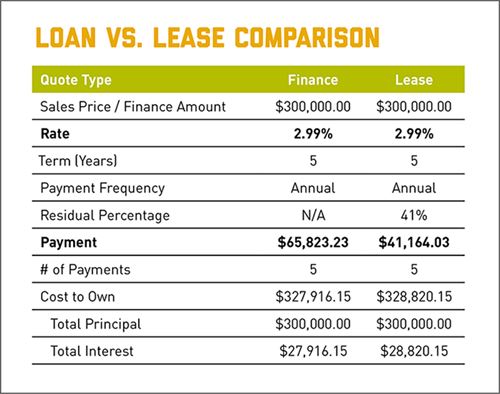

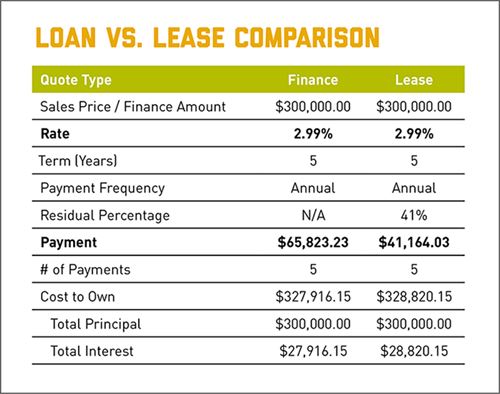

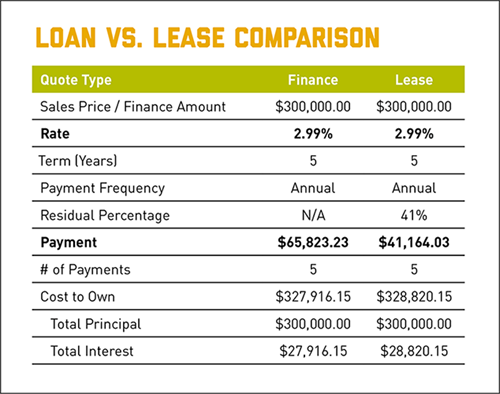

The following example compares an estimated loan versus lease payments for a new row crop tractor using a 5-year walk away lease agreement with a limit of 300 hours per year. In this comparison, the lease option lowers the annual payment by more than $24,000. The actual payment amount and residuals may vary depending on equipment brand, interest rate, closing date, asset valuation and other factors.

Maintenance and repairs

As equipment ages, increasing repair costs beyond routine maintenance can become a burden to equipment owners. Leased equipment, on the other hand, can be replaced before repair costs begin to mount.

Typically, lessees are responsible only for repairs not covered under warranty. Leasing can also reduce the risk of equipment obsolescence or breakdowns during critical times, such as harvest.

Depreciation

Another important leasing consideration includes the economic depreciation of farm machinery or it’s decline in asset value over time. Although this factor can be difficult to evaluate, the total cost of depreciation will be greatest during early ownership.

By leasing equipment, you can avoid having an asset that diminishes in value. However, by not owning the equipment you won’t build equity in the asset. It’s important to evaluate other aspects of your operation such as your trade-in frequency or future land purchases when weighing your options.

Technology

Whereas buying locks producers into long-term ownership, leasing gives producers access to the latest technologies. New technology does not guarantee economic return, but if applied correctly it may result in time or cost savings.

For example, leasing a larger, faster or more reliable machine may allow you to cover more acres in less hours, automate field operations or maximize inputs through precision applications.

Tax implications

Finally, producers who choose to lease their equipment may be able to take advantage of substantial tax savings under Section 179. From a tax perspective, two of the most popular types of leases are a true tax lease and a conditional sales lease.

With a true tax lease, you can deduct your full lease rental payment as an operating expense rather than depreciating the asset. With a conditional sales lease, you deduct depreciation and interest just as you would with a loan while still benefiting from a lower lease payment.

AgDirect offers both true tax leases and conditional sales leases to meet your operation’s needs and unique tax situation.